Impact Investing

Providing access to capital through philanthropy

Access to capital is an essential community resource. It allows local businesses to invest in their growth and job creation, for housing developments to meet resident demand while remaining affordable, for projects that serve the community — such as early childhood education centers — to meet the needs of families. The benefits of such investments are clear: long-term social gains, economic strength and wealth creation. However, communities of color do not experience equitable access to capital. Systemic racism forged barriers to financial and social resources that persist today for many in greater Milwaukee.

The purpose of the Greater Milwaukee Foundation’s impact investing program is to bridge these generational wealth gaps by providing affordable access to capital to support thriving communities, particularly communities of color. Our program emphasizes equity through key economic building blocks including small businesses and entrepreneurship, housing and early childhood education. Through these priorities and more, our impact investments help address social needs, create jobs, build wealth and expand opportunity.

What is impact investing?

Impact investing is philanthropy’s way of supporting businesses, developments, projects and entrepreneurs that bring tremendous social and economic value to the community beyond the scope of conventional nonprofit grantmaking.

Often structured as loans, equity investments or guarantees, impact investments provide timely support while ultimately delivering a financial return so funds can be reinvested in new projects, creating a cycle of sustainability.

Through our impact investing program, the Foundation carefully invests in places and opportunities where private and public funding have been inadequate, and racial inequities have stifled potential.

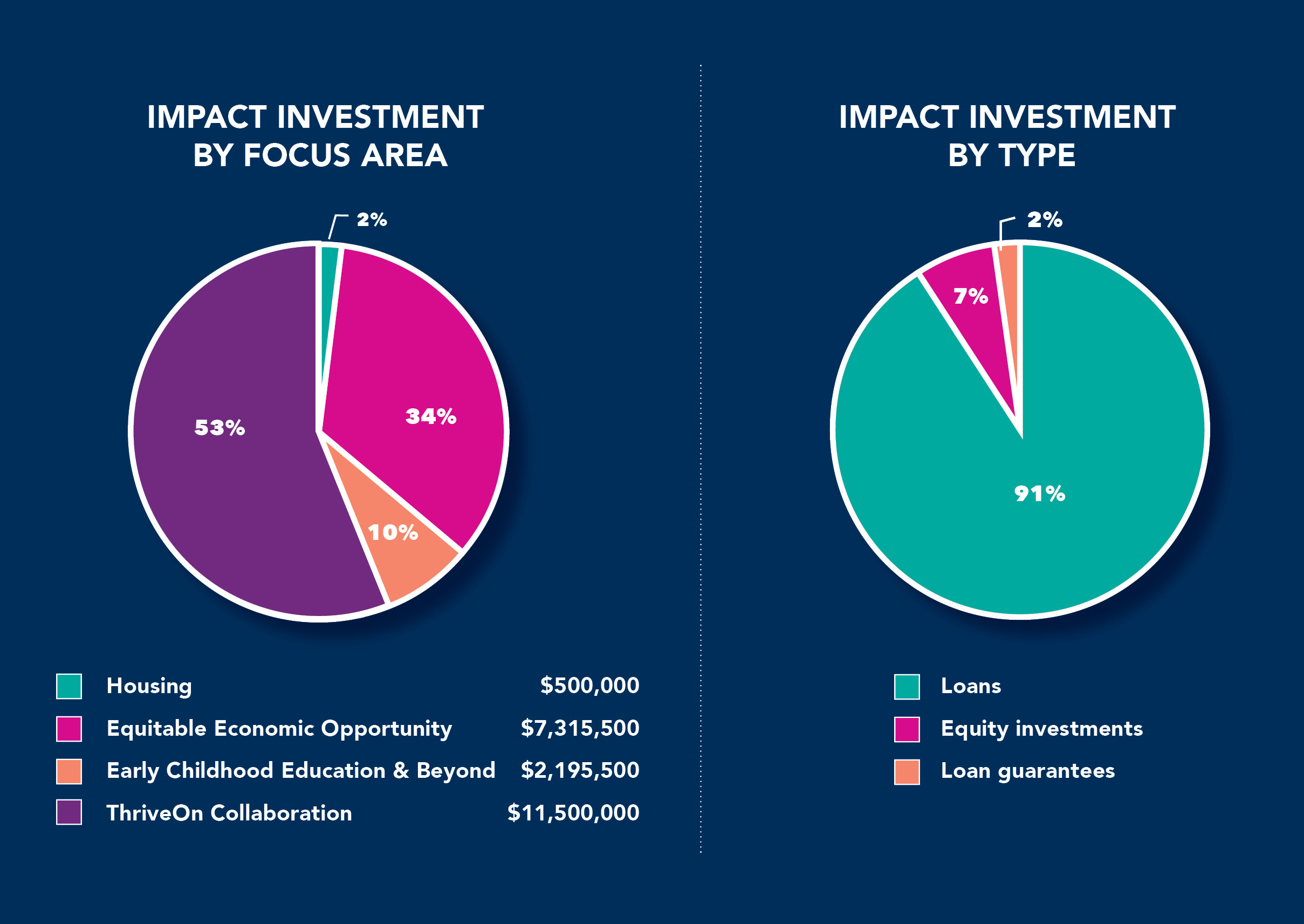

Focus areas

Early childhood education and beyond - Increasing the supply of quality providers and building the early childhood teaching workforce; other opportunities for educational impact

Equitable economic opportunity - Supporting entrepreneurs, creating jobs and building wealth in communities including small business, venture capital, commercial real estate and other community developments

Housing - Increasing the supply of safe, affordable housing to help fill the 32,000-unit gap in Black and Brown communities

ThriveOn Collaboration – Mission-related investment in the ThriveOn King development and providing community resources along the Dr. Martin Luther King Drive commercial corridor

To see if your project is eligible for an impact investment, read our impact investing guidelines.

Our vision

Deploy $30 million through 50 impact investments from 2020-2025

How dollars are deployed

Total impact investing dollars deployed, or approved with deployment pending, since 2017*

$19.5M

*The Foundation deployed an initial $1 million from existing funds between 2017-19 in an impact investing pilot program.

Impact investing in action

Home rehabilitation & ownership

Investment supporting home renovations through Home MKE housing rehabilitation program. Read more >

Investment supporting home renovations through Home MKE housing rehabilitation program. Read more >

Advancing educational equity

Investment supporting construction of Dr. Howard Fuller Collegiate Academy’s new school building in Bronzeville. Read more >

Investment supporting construction of Dr. Howard Fuller Collegiate Academy’s new school building in Bronzeville. Read more >

Cultivating business growth

Investment in JCP Construction, supporting the Black-owned firm’s growth and job creation. Read more >

Investment in JCP Construction, supporting the Black-owned firm’s growth and job creation. Read more >

Thrive On Small Business loans

Low-interest loans for 17 predominantly Black- and Brown-owned small businesses to hire, sustain or grow operations. Read more >

Low-interest loans for 17 predominantly Black- and Brown-owned small businesses to hire, sustain or grow operations. Read more >

Filling a venture capital void

Investment in Gateway Capital, a Black- and woman-led venture capital firm focused on pre-revenue start-ups. Read more >

Investment in Gateway Capital, a Black- and woman-led venture capital firm focused on pre-revenue start-ups. Read more >

Building on community vision

$10 million mission-related investment in ThriveOn King, a historic redevelopment and future community hub on King Drive

Read more >

More impact investing references

Give to impact investing

- Contribute to the Foundation’s Impact Investing Fund, which invests in promising opportunities throughout our city to create both social and financial returns

- Co-invest in the ThriveOn Small Business Loans program to create economic opportunity in the Halyard Park, Harambee and Brewers Hill neighborhoods prioritized by the ThriveOn Collaboration